AI Governance for LATAM and Caribbean Financial Institutions: Oversight as the New Credibility Benchmark

By Stanley Foodman May 2025 In 1942, science fiction writer Isaac Asimov introduced three laws to govern intelligent machines. While visionary, these laws ultimately fell short because they couldn’t account for context, loopholes, and the inherent flaws in human-designed systems. Today, financial institutions across Latin America and the Caribbean face a real-world parallel: How do […]

Three Ways Forensic Reporting Builds Institutional Integrity

by Foodman CPAs & Advisors In today’s increasingly litigious and compliance-driven environment, transparency is no longer optional. It’s foundational. Across LATAM and globally, recent trends point to a noticeable rise in regulatory inquiries, shareholder disputes, and enforcement actions. As a result, executive teams and boards are placing greater emphasis on auditability, documentation, and the […]

Tax Transparency in Cross-Border Structuring: What LATAM Institutions Should Prepare for in 2025

by Foodman CPAs & Advisors As global tax transparency standards evolve, financial institutions across Latan America (LATAM) are facing rising expectations, particularly in how they manage cross-border structuring, beneficial ownership disclosure, and digital asset reporting. The latest OECD compliance updates signal a strategic shift: tax transparency is no longer a matter of passive reporting. It […]

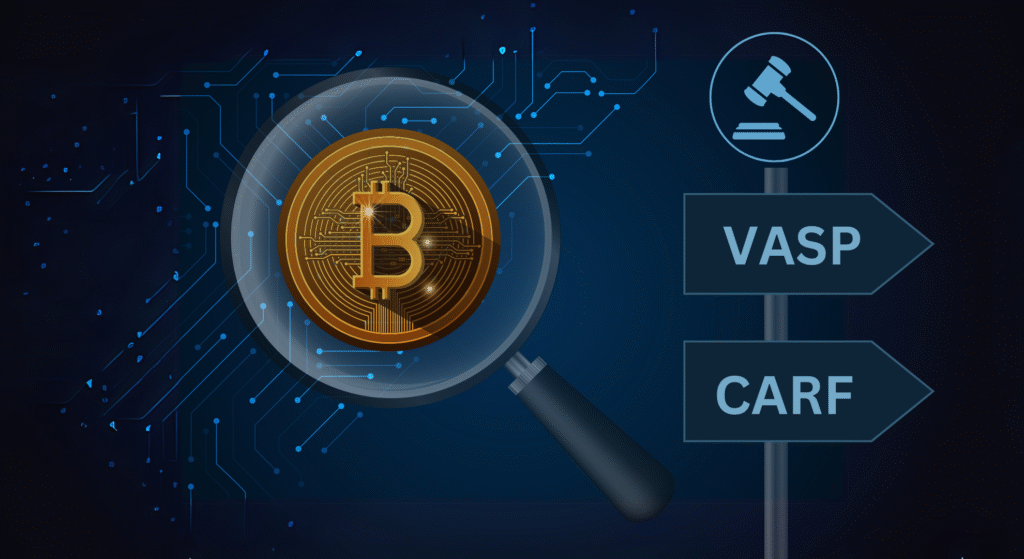

Crypto Compliance: Are You Ready for CARF and VASP Regulations?

The introduction of the Crypto-Asset Reporting Framework (CARF) and evolving standards for Virtual Asset Service Providers (VASPs) represent a seismic shift in global regulatory expectations for cryptocurrency. Despite clear signals from regulators, many financial institutions, especially across LATAM, remain unprepared, creating dangerous compliance blind spots. Historically, cryptocurrencies operated in environments perceived as resistant to oversight. […]

The Compliance Gap in AML AI: Why Audit-Ready Tools Matter

AI-powered AML tools are everywhere—but many can’t pass an audit. As the market for anti-money laundering (AML) software explodes, fueled by financial crime, regulatory pressure, and AI innovation, many platforms promise efficiency, speed, and reduced false positives. But beneath the surface lies a critical gap: audit readiness. For compliance officers and financial institutions across LATAM […]

AI Governance in LATAM: Why Oversight is the New Credibility Standard

Why Guardrails Matter More Than Ever in the Age of Quantum and DNA-Driven Processing By Stanley Foodman In 1942, science fiction writer Isaac Asimov proposed three simple laws to govern intelligent machines. They were elegant. They were clear. And, if you’ve read Asimov, you know, they failed. Why? Because context matters. Loopholes emerge. And systems […]

Compliance Is Not a Cost Center: It’s a Strategic Advantage

By Stanley Foodman, CEO of Foodman CPAs & Advisors In a global environment where regulations are rapidly evolving and oversight agencies are increasing scrutiny, many organizations are asking the wrong question: “How much does compliance cost us?” The better question is: “What does it enable us to achieve?” For too long, regulatory compliance has been […]

CRS 3.0: What LATAM Compliance Teams Need to Know Now

In 2024, the OECD introduced a major update to the Common Reporting Standard (CRS), known as CRS 3.0. While formally adopted in 2024, 2025 is a critical transition year for financial institutions and jurisdictions preparing for mandatory compliance beginning January 1, 2026, with the first reports due in 2027. For compliance officers, family offices, and […]

FATCA Responsible Officer Certifications due 7/1/25

On 1/21/25, the IRS issued Bulletin Issue Number: 2025-02 to remind the FATCA Responsible Officer that Certifications are due 7/1/25 for the Certification period ending December 31, 2024. The Bulletin also provided a reminder to users of the new FATCA Registration System sign-in options. Entities that are required to certify ought to keep in mind […]

NTA Addresses Overlap Reporting

On 1/8/25, the National Taxpayer Advocate (NTA) published its 2024 Annual Report to Congress and identified taxpayers’ problems and provided suggestions to further protect taxpayer rights and ease taxpayer burden. “By law, the National Taxpayer Advocate’s report must identify the ten most serious problems taxpayers face in their dealings with the IRS and make administrative […]

Beneficial Ownership Information Access

On 11/15/24, FinCEN updated two Beneficial Ownership Information Access FAQs. The theme of the 11/15/24 update is Beneficial Ownership Access in accordance with the Corporate Transparency Act. FinCEN had previously update the its FAQ Section on 4/18/24 when they added a new section titled “Access to BOI Information”. This was a new section that addressed […]

BIS New Guidance for FI’s Best Practices

On 10/9/24, the Bureau of Industry and Security (BIS) within the Department of Commerce has issued guidance aimed at financial institutions (FIs), outlining best practices for adherence to the Export Administration Regulations (EAR). This BIS new guidance offers foundational information regarding the EAR and outlines measures that financial institutions can implement to reduce the risk […]