On February 12,2020, the U.S. Government Accountability Office (GAO) published a Report on Virtual Currencies which discusses whether Taxpayers who use Virtual Currency (VC) are fully meeting their tax obligations. The purpose of the GAO report is to address IRS’ efforts related to VC tax compliance, guidance, and information reporting (which involves third parties, such as financial institutions reporting information on taxpayer income or transactions to IRS and taxpayers). The Report estimates that there are more than 10,000 taxpayers who may not have properly reported VC transactions on their tax returns.

Taxpayers have Responsibilities

Taxpayers are required to report and pay income taxes from virtual currency use. Transactions that could affect taxable income are:

- selling virtual currency for US dollars

- exchanging one type of virtual currency for another

- receiving virtual currency for services

- mining virtual currency

Transaction that do not affect taxable income are:

- Buying VC with dollars and just holding on to it

- Sending VC to a different virtual currency wallet under the same account owner

Taxpayers using VC must keep track of transaction-level information, such as the fair market value of the virtual currency at the time it was obtained, to determine tax basis and calculate gains or losses. The gain or loss from the sale or exchange of VC is classified as either a capital gain or loss, or an ordinary gain or loss, depending on whether the VC is held as a capital asset.

But Taxpayers are having difficulty due to:

- Limited information reporting by third parties.

- Recordkeeping challenges. Reporting VC income accurately under IRS guidance, entails taxpayers reporting information about each transaction, including cost basis and fair market value at the time VC is disposed of, such as by selling it for cash, or another VC on an exchange or using it to purchase goods and services

Limited Information Reporting and Guidance from IRS

IRS specific guidance relating to VC includes: Notice 2014-21, issued in March 2014, as well as Revenue Ruling 2019-24 and Frequently Asked Questions (FAQs) released in October 2019. The general sentiment is that VC and taxes is confusing and burdensome.

Despite the confusion and lack of clarity, the IRS also has taken some steps to address virtual currency compliance risks

- launching a virtual currency compliance campaign in 2018

- working with other agencies during criminal investigations.

- sending out more than 10,000 letters to taxpayers with virtual currency activity informing them about their potential tax obligations

The 2019 Form 1040 has a VC question on Schedule 1

IRS added a question asking if taxpayers received, sold, sent, exchanged, or otherwise acquired any financial interest in any VC during the 2019 tax year. Only taxpayers who would answer “yes” to the question need to file Schedule 1.

No FATCA and No FBAR Requirements!

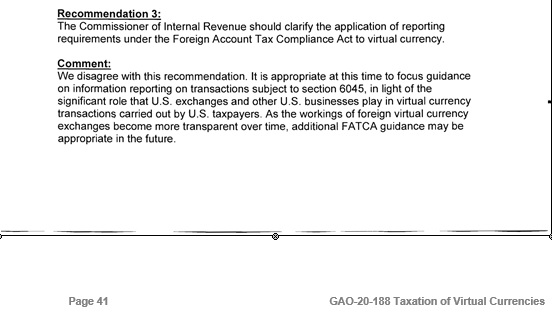

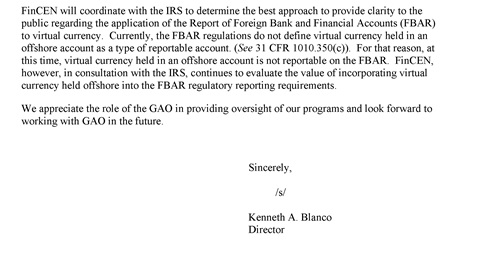

With respect to FATCA and FBARs, the GAO report states:

FATCA

FBAR

The IRS is determined to audit the VC sector and close out or narrow the Reporting Gap

Taxpayers that are investing, making payments or receiving payment in VC ought to consult a tax specialist. Taxpayers may be subject to penalties for failure to comply with tax laws. Underpayments attributable to virtual currency transactions may be subject to penalties. VC transactions are not exempt from Government regulation and reporting. The burden is on the Taxpayer to report voluntarily and pay taxes on VC gains earned. Taxpayers also ought to implement sound VC record keeping for tracking their capital gains and losses.