Navigating the Future: Corporate Governance Challenges in 2025

Por favor haga clic en este enlace para leer en español. [To hear audio excerpts on each topic, click the topic title.] As financial institutions prepare for the rapidly evolving corporate governance landscape, Stanley Foodman, CEO of Foodman CPAs & Advisors, and Isabelle Wheeler, Managing Director of Regulatory Compliance, shared their insights, offering a glimpse […]

Foodman’s Help Desk: Your On-Demand Compliance Solution

The Help Desk at Foodman CPAs & Advisors is designed to provide financial institutions and businesses with on-demand, expert assistance for a wide range of regulatory compliance challenges. This service is particularly beneficial for addressing complex, time-sensitive issues across various regulatory frameworks. Here are some specific situations where the Help Desk can assist: The Help […]

FATCA Responsible Officer Certifications due 7/1/25

On 1/21/25, the IRS issued Bulletin Issue Number: 2025-02 to remind the FATCA Responsible Officer that Certifications are due 7/1/25 for the Certification period ending December 31, 2024. The Bulletin also provided a reminder to users of the new FATCA Registration System sign-in options. Entities that are required to certify ought to keep in mind […]

IRS Pilot Mediation Programs

On 1/15/25, the IRS announced three pilot programs to test changes to existing Alternative Dispute Resolution (ADR) programs. The new IRS Pilot Mediation Programs are designed to help taxpayers resolve tax disputes earlier and more efficiently. The IRS Pilot Mediation Programs announcements pertain to the implementation of pilot programs centered on Fast Track Settlement (FTS) […]

Tax Preparation 2025 Useful Pointers

On 12/19/24, anticipating the 2025 filing season, the IRS published Tax Preparation 2025 Useful Pointers in IR-2024-311: Prepare to file in 2025: Get Ready for tax season with key updates, essential tips. As the 2025 filing season draws near, the Internal Revenue Service (IRS) has urged taxpayers to undertake essential preparations for submitting their 2024 […]

NTA Addresses Overlap Reporting

On 1/8/25, the National Taxpayer Advocate (NTA) published its 2024 Annual Report to Congress and identified taxpayers’ problems and provided suggestions to further protect taxpayer rights and ease taxpayer burden. “By law, the National Taxpayer Advocate’s report must identify the ten most serious problems taxpayers face in their dealings with the IRS and make administrative […]

Charitable LLCs Warning from IRS

On 11/4/24, the Internal Revenue Service issued a warning to taxpayers regarding the dangers of engaging with promoters of fraudulent tax schemes that involve donating ownership interests in closely held businesses, often referred to as “Charitable LLCs.” These schemes frequently target individuals with higher incomes and are classified as abusive transactions by the IRS. Typically, […]

IRS Consumer Alert to Avoid Scams

On 12/2/24, the IRS, along with its Security Summit partners, issued an IRS Consumer Alert and cautioned taxpayers to exercise heightened vigilance during their holiday shopping, as scammers are actively seeking personal information from potential victims. This IRS Consumer Alert marks the beginning of the ninth annual National Tax Security Awareness Week, which provides valuable […]

Beneficial Ownership Information Access

On 11/15/24, FinCEN updated two Beneficial Ownership Information Access FAQs. The theme of the 11/15/24 update is Beneficial Ownership Access in accordance with the Corporate Transparency Act. FinCEN had previously update the its FAQ Section on 4/18/24 when they added a new section titled “Access to BOI Information”. This was a new section that addressed […]

BIS New Guidance for FI’s Best Practices

On 10/9/24, the Bureau of Industry and Security (BIS) within the Department of Commerce has issued guidance aimed at financial institutions (FIs), outlining best practices for adherence to the Export Administration Regulations (EAR). This BIS new guidance offers foundational information regarding the EAR and outlines measures that financial institutions can implement to reduce the risk […]

Deepfake Media FinCEN Fraud Alert

On 11/13/24, FinCEN issued an alert aimed at assisting financial institutions in recognizing fraudulent schemes linked to the utilization of deepfake media generated by generative artificial intelligence (GenAI) tools. The alert for deepfake media outlines the various typologies related to these schemes, offers red flag indicators to aid in the detection and reporting of suspicious […]

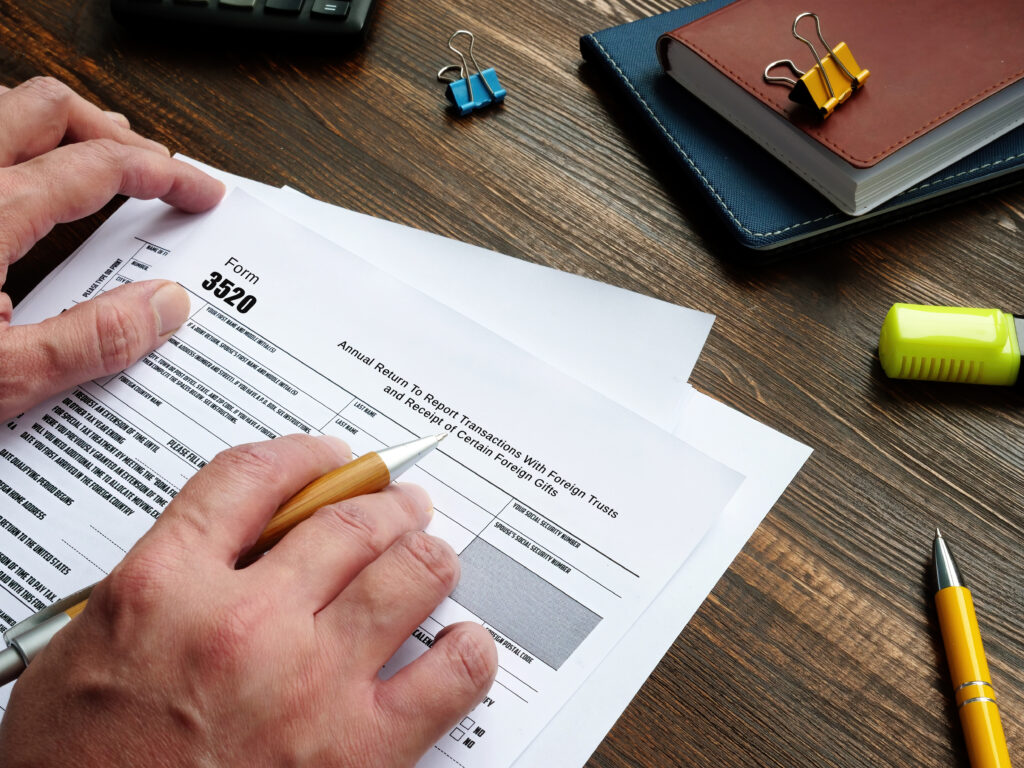

Forms 3520 and 3520-A Late Filing get IRS Relief

On 10/24/24, the National Taxpayer Advocate shared on its NTA Blog that the IRS has discontinued its policy of automatically imposing penalties for late submissions of Form 3520, which pertains to foreign gifts and inheritances reported in Part IV of the form. By the end of the year, the IRS plans to start evaluating “reasonable […]