What happens when Taxpayers try to tell the IRS that it is not “Mea Culpa”?

According to the IRS Manual, reasonable cause for abating penalties is based on all the facts and circumstances of a Taxpayer’s situation. IRS will consider reasons which establish that a Taxpayer used all ordinary care and prudence to meet required Federal tax obligations but were nevertheless unable to do so. So, when Taxpayers attempt to […]

Audit Time for High Income Individuals and their Companies has arrived

On a webinar hosted by the New York University Tax Controversy Forum on June 18, 2020, Douglas O’Donnell (head of the IRS Large Business and International Division/IRS-LBI) stated that the IRS will begin a new campaign to audit hundreds of high-net-worth individuals from July 15, 2020 to September 30, 2020. The audit campaign stems from […]

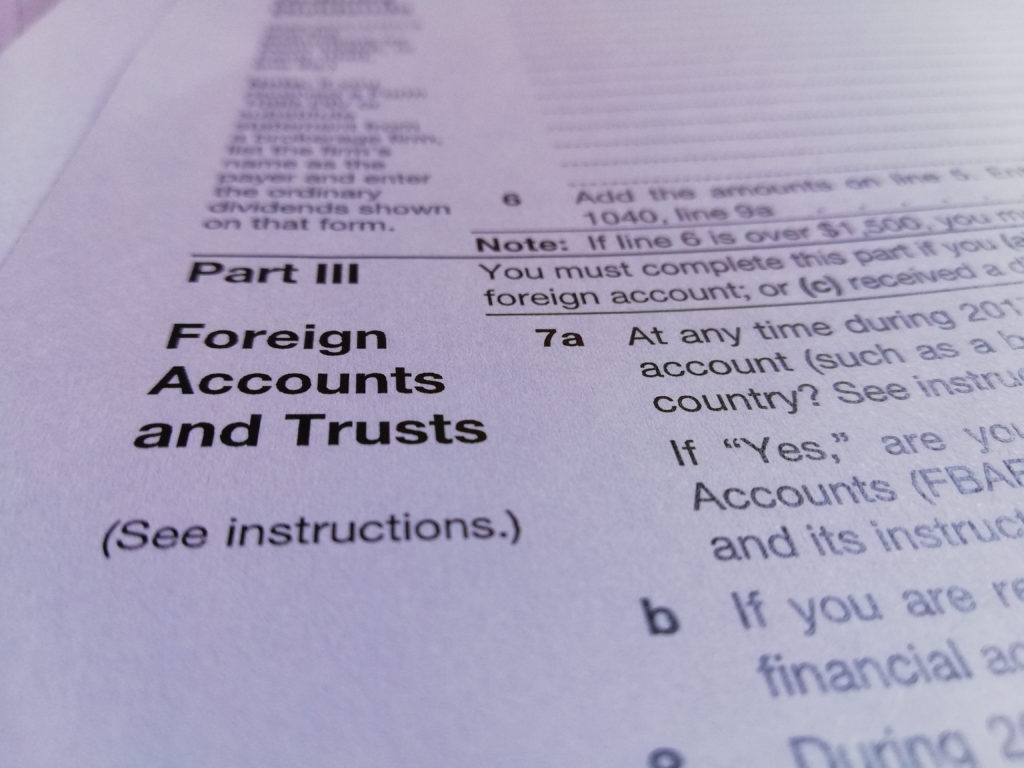

Willfulness and IRS Foreign Account Reporting Requirements

The IRS Mission Statement states that: “the taxpayer’s role is to understand and meet his or her tax obligations”. Taxpayers fill out their own returns under a “self-assessment voluntary reporting system” because the Taxpayer is the one that possess all the information and not the IRS. A Taxpayer’s actions may create the difference between an […]

Did you know that IRS reinstated the “ASFR” program in 2019?

Under Internal Revenue Code, Section 6620, if a Taxpayer does not timely file a U.S. tax return, the IRS is authorized to prepare and file a U.S. tax return for that Taxpayer based on the knowledge that it has on hand. The return prepared by the IRS is called a Substitute for Return (SFR). The […]

How does the “Accounting” for a Forgivable Loan received under the PPP work?

The PPP (Paycheck Protection Program) was established by Congress to assist small businesses during the Covid-19 pandemic as part of the $2 trillion CARES Act. Via the PPP, the U.S. Treasury requires the U.S. Small Business Administration (SBA) to fund loans up to $10 million for business borrowers to cover payroll, mortgage interest, rent, and […]

IRS has a Commitment to Service US Taxpayers and Enforce Collections Compliance

According to the Internal Revenue Code, Taxpayers have three obligations: (1) to file timely returns; (2) to file accurate returns; and (3) to pay the required tax voluntarily and timely. Voluntary compliance, in which Taxpayers determine the correct amount of their tax and complete appropriate returns, rather than the Government determining their tax for them […]

PPP Safe Harbor is meant to promote economic certainty for PPP borrowers with limited resources

On May 13, 2020, the U.S. Treasury published PAYCHECK PROTECTION PROGRAM (PPP) LOANS Frequently Asked Question (FAQ 46). It addresses SBA review of a borrower’s required good-faith certification concerning the necessity of a loan request. According to FAQ 46, the SBA and the U.S. Department of the Treasury provide a “good-faith certification safe harbor” for […]

PPP Loan Borrowers will need Assistance when Applying for Forgiveness of their PPP Loans

On 4/15/20, the SBA and the U.S. Department of the Treasury released an application form for Paycheck Protection Program (PPP) loan forgiveness along with instructions for completing the form. To apply for forgiveness of a Paycheck Protection Program (PPP) loan, the Borrower must complete the application and submit it to its Lender (or the Lender […]

How are Financial Institutions identifying and managing their PEP relationships?

With respect to customers, Financial Institutions are required to have processes in place for identifying Politically Exposed Persons – known as “PEPs”. They are individuals perceived as more vulnerable to corruption and bribery involvement due to a current or past governmental position of influence. Financial Institutions include the immediate family and close associates in the […]

Covid-19 and Non-Resident Aliens’ Emergency Time Period in the U.S.

Nonresident alien individuals (NRA) who perform services or other activities while in the United States, and foreign corporations who employ individuals or engage individuals as agents to perform services or other activities in the United States may be considered engaged in a U.S. trade or business (USTB). If Nonresident alien individuals performing those services or […]

What can Borrowers do to prepare for PPP Loan Program Audits?

Treasury Secretary Steven Mnuchin has stated that Businesses that borrow money through the PPP Loan Program may expect compliance audits before their loans are forgiven. Many banks, with the encouragement of the U.S. Treasury, “skipped” standard Know your Customer and Loan Due Diligence Procedures. The loan risk was compounded by Banks accepting loan applications from […]

Financial Institution OFAC Compliance and Bank Regulatory Agencies

While OFAC is responsible for promulgating, developing, and administering sanctions for the U.S. Secretary of the Treasury, bank regulatory agencies cooperate in ensuring OFAC financial institution compliance. Although OFAC is not by itself a bank regulator; its basic requirement is that financial institutions do not violate the laws that it administers. The U.S. Banking and […]