New Guide Includes Reporting Requirements and Potential Penalties

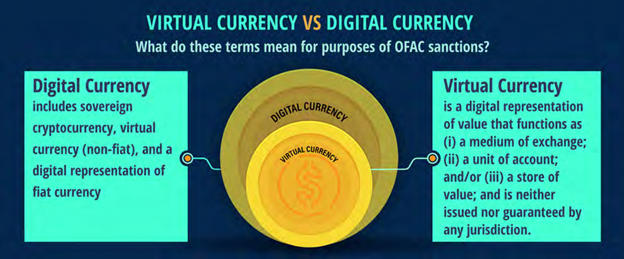

In a new Sanctions Compliance Guide, The Office of Foreign Assets Control (OFAC) of the U.S. Treasury reiterates that obligations apply equally to transactions involving virtual currencies and those involving traditional fiat currencies.

With a broad stroke, OFAC defines the Virtual Currency Industry as technology companies, exchanges, administrators, miners, wallet providers and financial institutions that may have exposure to virtual currencies or their service providers and users.

Non-compliance by the Virtual Currency Industry carries the same civil and criminal penalties as those faced by traditional financial institutions, according to the Guide.

To ensure compliance, members of the virtual currency industry must mitigate risks by not engaging, directly or indirectly, in transactions prohibited by OFAC sanctions. These include dealings with blocked persons or property or engaging in prohibited trade or investment related transactions.

OFAC is particularly concerned with cryptocurrency issues that facilitate illicit activities, including money laundering and ransomware attacks as well as business conducted with sanctioned states and other parties.

Because a “prepackaged” universal OFAC compliance program does not exist, the Virtual Currency industry must take steps to protect against potential sanctions violations.

Non-compliant Virtual Currency Industry members could be subject to adverse publicity, fines, and penalties and the complete blocking of their financial assets. OFAC has also issued Frequently Asked Questions on sanctions compliance and several case studies as examples of issues.

Crypto exchanges operating in the United States are required to

- register with FinCEN as money services businesses,

- license themselves in the states in which they operate

- exclude users in sanctioned jurisdictions and those on OFAC’s SDN List from transacting on the exchange.

How to create a sanctions compliance program for crypto exchanges and users

Here are key steps that crypto exchanges and users can take to create a sanctions compliance program:

- Management Commitment

● Review and support sanctions compliance policies and procedures

● Ensure adequate resources (human capital, expertise, information technology, and other resources)

● Delegate sufficient autonomy and authority to the compliance unit

● Appoint a dedicated sanctions compliance officer with the requisite technical expertise - Risk Assessment and Internal Controls

The Guide says that creating an adequate compliance solution for members of the industry will depend on the type of business involved, its size and sophistication, products and services offered, customers and counterparties, and geographic locations served, as well as any sanctions-specific risks the company identifies during its risk assessment process. - Testing and Auditing

OFAC states that some of the best practices for testing and audit procedures in sanctions compliance programs for the virtual currency industry include:

● Sanctions List Screening,

● Keyword Screening,

● IP Blocking, and Investigation/Reporting Review procedures. - Training

OFAC training should be provided to all appropriate employees and should be conducted regularly on a periodic basis, incorporating emerging technologies in the Virtual Currency space.

OFAC Penalties

The Guide also lists the penalties for sanctions noncompliance and makes clear that they will be severe.

The most comprehensive sanctions programs that OFAC administers typically include several or all of the following types of sanctions, while other sanctions programs may only employ some of these options:

● Broad trade-based sanctions or embargoes

○ These usually include a prohibition on importing or exporting goods or services to or from the sanctioned jurisdiction. Such sanctioned jurisdictions currently include Cuba, Iran, North Korea, Syria, and the Crimea region of Ukraine.

● Government or regime sanctions

○ either (1) require the blocking of all property and interests in property of a particular foreign government or regime that are or come within the United States or the possession or control of a U.S. person, or (2) prohibit specific types of transactions and activities involving a particular foreign government or regime.

● List-based sanctions

○ These target specific, listed individuals and entities and either (1) require the blocking of all property and interests in property of those listed persons or (2) prohibit specific types of transactions and activities with listed persons.

● Sectoral sanctions

○ target individuals and entities operating in specific sectors of a foreign country’s economy or prohibit specific activities associated with a sector of a foreign country’s economy. ©